What Is An Insurance Restoration Specialist?

Most people think that Insurance Restorations Specialists and the Insurance Adjuster are the same. This is far from reality because the Insurance Adjuster that comes out to your home after it was damaged works for the insurance company, not for you. The adjuster may be the nicest, most sincere human ever; their job is to spend as little money as possible on your project.

An Insurance Restoration Specialist is a reputable licensed contractor that works for you to get everything you deserve from your insurance provider to get your home back after a disaster. They can meet with the insurance adjuster on your behalf to answer the adjuster’s questions regarding what is needed to restore your home.

What Does Insurance Restoration Specialists Do?

An Insurance Restoration Specialist is a specialty contractor that works with homeowners after disaster strikes. They can help you navigate your insurance to complete your projects. Common projects would be roof replacement after a hail storm or roof repair from wind damage.

An Insurance Restoration Specialist should be your first call to assess the damage to your home and call your insurance adjuster on your behalf. They will typically meet in person when the Claims Adjuster shows up for inspection. A Specialist can answer any claims adjuster questions and explain what work needs to be done.

Share This Post:

Like us on FaceBook!

Send Us A Message

What Is Different Between A Roofer & Insurance Restoration Specialists?

A few main differences between a general roofer and a roofing restoration specialist are listed below.

An Insurance Restoration Specialists will:

- Provide 24/7 emergency response, ready and able to respond when disaster strikes.

- Work with your insurance company to get you everything you deserve.

- Make sure that you get reimbursed for code upgrades.

- Have relationships with local municipalities and understand the current codes.

- Prevents further damage by identifying the damage and expediting your insurance claim.

- Establish relationships with top insurance carriers.

Can An Insurance Restoration Specialists Fix My Roof?

When an Atlantic Hurricane strikes Edgewater, Maryland, that can spell disaster for your home’s roof. Make your first call to a Roofing Insurance specialist to inspect and find any damage caused by the storm. As long as they are licensed to perform roofing in Maryland, an Insurance Restoration Specialist can fix your Edgewater roof.

Does Homeowners Insurance Cover Roof Replacement?

Yes, IF it was damaged from an act of nature or sudden accident (check your policy for specifics).

Acts of nature that can damage your roof and warrant an insurance claim could include but are not limited to:

- A tornado ripped your roof off.

- A hurricane or wind storm blowing shingles off of your roof.

- A hail storm does impact damage, reducing the effectiveness of the shingles.

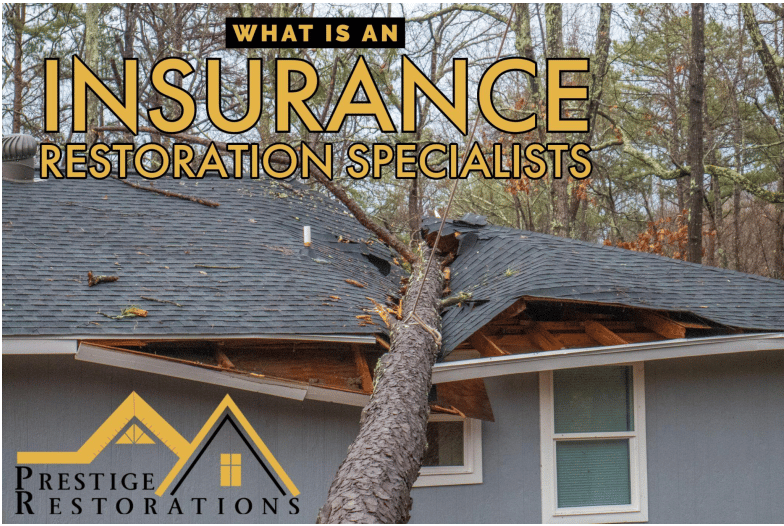

- A tree falling on your roof, breaking through and making a hole.

- A home fire.

- Damage from an aircraft landing or crash.

- Damage from a vehicle.

- Weight from ice.

However, if you have an aging roof leaking due to normal wear and tear, your insurance policy might not cover it. The best thing to do in Edgewater, Maryland, is to call a top Roofing Insurance Claims Specialists to inspect your roof. After the inspection, they can advise you on what you can claim with your insurance company.

How Do I Get Insurance To Pay For Roof Replacement?

- the First step is to understand your roofing insurance coverage and what it covers for roof repair and replacement. Unfortunately, insurance may not cover all types of roof damage. Studying your policy and understanding what is covered when it comes to your roof is essential.

- Second is to make a call to an Insurance Claims Specialist immediately after your roof gets damaged. They can help with understanding your policy and what is covered.

- Document the damage. Get lots of photos of the damaged area of the roof and any damage to the inside. We recommended hiring a professional to photo document the damage and save yourself a fall from the roof or ladder.

- Contact your insurance company. The insurance claims specialists can reach out to the insurance company on your behalf and meet with the adjuster when they arrive on site.

- Follow up after claim approval and hire a roofing contractor to replace your roof.

Not all damage is covered, and it is vital to get full documentation before and after photos of the damaged area. To get the before images, reach out to a roofing professional to get an inspection and photo documentation of your roof.

Being ready with complete documentation will help you make your claim to the insurance companies. Working with an Insurance Claims Specialists will help you take proper steps to get your roof repair or replacement covered by your insurance.

How Do I Avoid Roofing Insurance Scams?

There is one around every corner; crooks are looking to get your money and run. Here is how it happens: After a storm blows through your neighborhood, someone claiming to be a contractor offers free inspections while they are in the area working on a neighbor’s roof. You think, why not? There was a storm, and the contractor is doing work in the neighborhood; what could go wrong? That is just the start; scammers typically are there to pressure you to sign a contract right then and try to get you to pay upfront to get the “special deal.’

What you don’t know is the special deal they are referring to is taking your money and never coming back.

Nothing good comes from giving an unsliced contractor any cash on the spot.

To protect yourself:

- Have the solicitor make an appointment, stating that you don’t have time right now to let them inspect your roof.

- Ask for any company literature you can take with you to do more research.

- Let the solicitor know that you will get more bids on your roof before making any decisions.

Before signing any contracts, ensure you see proof of licensure and insurance at the bare minimum. It’s not a bad idea to ask for the names of people they have worked for in the neighborhood; that way, you can ask them yourself.

Roofing Insurance Specialists in Edgewater, Maryland

If you are in the Edgewater, Maryland area and have experienced damage to your roof, give us a call today! We are Licensed, Insured, and Bonded, and no job is too big or too small!